By Kenny Coinz — for the investors who think deeper

There was a time when Jumia Technologies (JMIA) was the chosen one.

The Amazon of Africa, they called it.

Every retail investor with an eye on frontier markets circled the ticker.

Africa 1.4 billion people, mobile-first, digitally starved what could go wrong?

Turns out… a lot.

So here’s the question you need to ask yourself right now:

Is JMIA still a sleeping giant or is it a cautionary tale?

Because if you’re still holding… or thinking of buying…

You better know exactly what game you’re playing.

What’s the Truth About Jumia in 2025?

The stock’s not dead, but it sure as hell ain’t alive.

JMIA is limping somewhere under $5, struggling to breathe above water.

Its market cap? A fraction of what it once was—less than $500 million.

Once hailed as the golden ticket to African e-commerce riches…

Now it’s a microcap graveyard, haunted by broken promises and missed margins.

So what happened?

Let’s break it down.

The Big Dream: What JMIA Was

Supposed

To Be

Jumia was going to be Africa’s digital mall.

Retail, groceries, phones, electronics, fashion, all in one platform.

Then came JumiaPay, a fintech play for the underbanked.

Then came Jumia Logistics, the backbone for last-mile delivery across the continent.

The dream was enormous.

So were the problems.

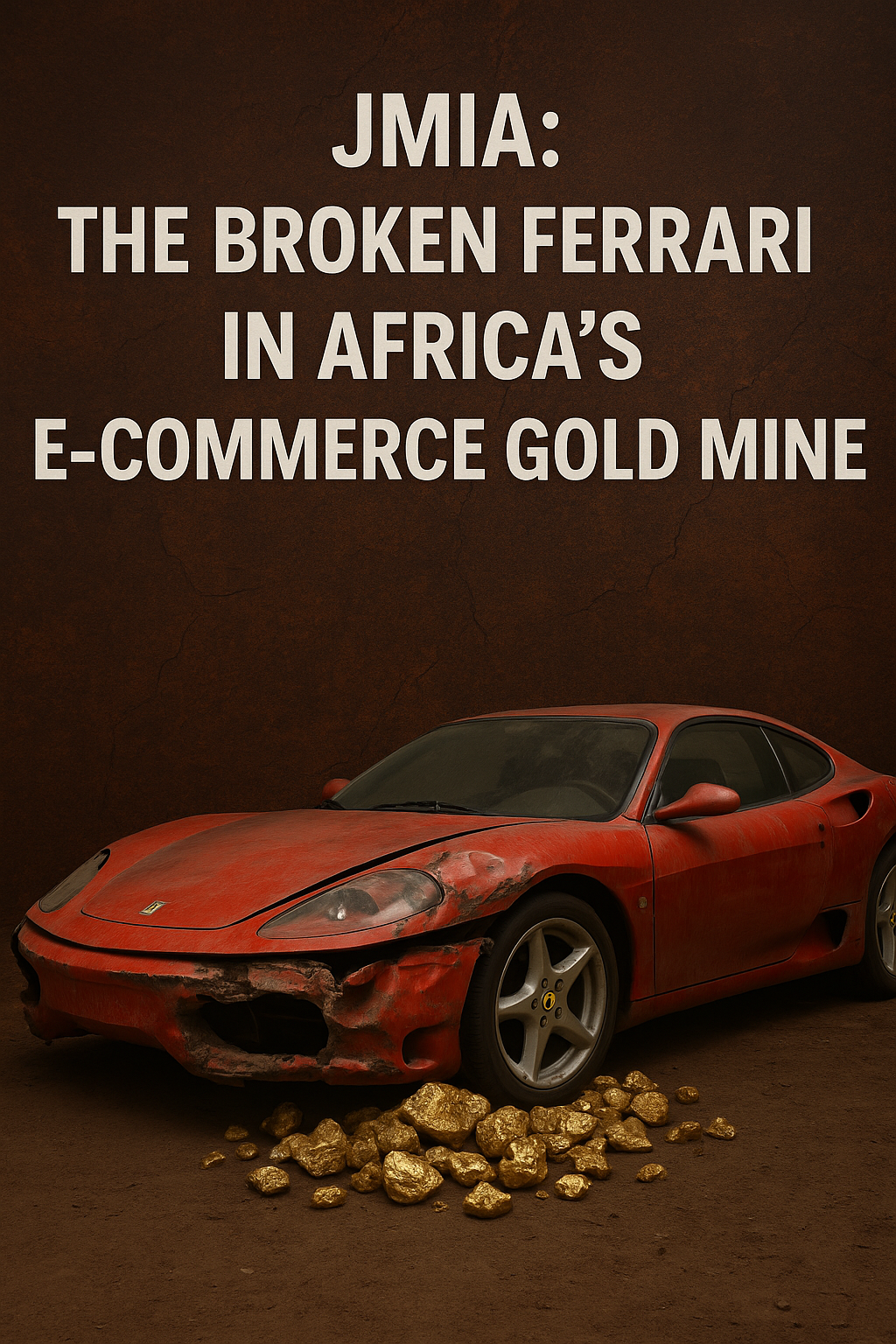

The Ugly Reality: Why the Ferrari Won’t Start

Let’s not sugarcoat this:

- Profitability? Still nowhere in sight.

- Revenue? Flat or declining.

- GMV growth? Weak.

- Costs? Ballooning.

- Trust from investors? Long gone.

Jumia bled money for years. Then, when it tried to pivot toward profitability, it started shrinking operations.

It cut jobs. Shut down in markets. Downsized warehouses.

And here’s the worst part:

Even when it stopped trying to be everything to everyone…

It still hasn’t proven it can be anything well.

So let me ask you:

Are you investing in potential… or clinging to nostalgia?

The Bull Case: Is There Still Gold in the Dirt?

Now, if you’re still bullish on Jumia, you’re likely leaning on three ideas:

- The Africa Macro Thesis:

Africa is still a land of untapped digital demand.

1.4 billion people. Mostly under 25. Mobile-first. Huge potential for leapfrogging. - The Infrastructure Pivot:

Maybe Jumia stops trying to be a retailer and just becomes the FedEx of Africa.

Maybe JumiaPay quietly scales into a credible digital bank. - Acquisition Hail Mary:

The stock is dirt cheap. Someone big might come along and scoop it up.

Sounds nice. But let’s not play fantasy football with your money.

The Bear Case: What You’re Really Buying

This is where it gets uncomfortable.

Because here’s what you’re really holding if you own JMIA right now:

- A company burning cash like it’s still 2021.

- A brand with declining trust—among both investors and consumers.

- A business model still unproven in Africa’s fractured infrastructure landscape.

- A stock constantly at risk of stock dilution, delisting, or irrelevance.

Even the Amazon of Africa can’t scale if people don’t have dependable addresses, roads, or disposable income.

So… what exactly are you waiting for?

Let’s Talk Strategy

If you’re in JMIA now, what’s your move?

- Are you just hoping for a 2x bounce off the floor?

- Are you waiting for a turnaround CEO to clean house?

- Or are you sitting in denial, bag-holding from 2020 dreams?

There’s no shame in cutting losses if the thesis broke.

There’s also no glory in being the last one out the door.

But if you’re still buying now, you better treat this like a trade, not an investment.

This is not a long-term compounding machine. This is a wounded animal.

It could recover.

It could also bleed out quietly in the corner of your portfolio.

Final Thought: Are You Investing in a Dream… or Chasing a Ghost?

Jumia was a Ferrari parked on the edge of a gold mine.

But now?

It’s dusty. It’s rusted. The engine won’t turn.

And the map to the gold is missing.

So what are you really holding onto?

A dream?

A narrative?

A lottery ticket?

Or is it time to be honest with yourself?

Because real wealth doesn’t come from hoping a broken Ferrari somehow wins the race.

It comes from clarity. From asking the hard questions. From knowing when to bet heavy—and when to walk away.

So I’ll ask again:

Is JMIA your opportunity… or your excuse?

You decide.

—

If you want me to chart this technically, price it against macro data, or build an options strategy around it, just say the word or better yet leave a comment

Discover more from Marathon Money +

Subscribe to get the latest posts sent to your email.